A sum of money placed with a bank for a defined period of time is known as a Fixed Deposit (FD). A Fixed Deposit is easy to use as it can be transacted at any commercial bank. Most people will have at least one banking relationship. For them, an FD has been a first-choice investment as and when they have had money they could be put away.

Banks have promoted FDs as it provides them greater certainty of funds at a relatively low rate. It should also be possible to open and close FDs through the online service offered by banks.

Anyone (including NRIs, with certain specific conditions) can open an FD with any commercial bank in India.

Return

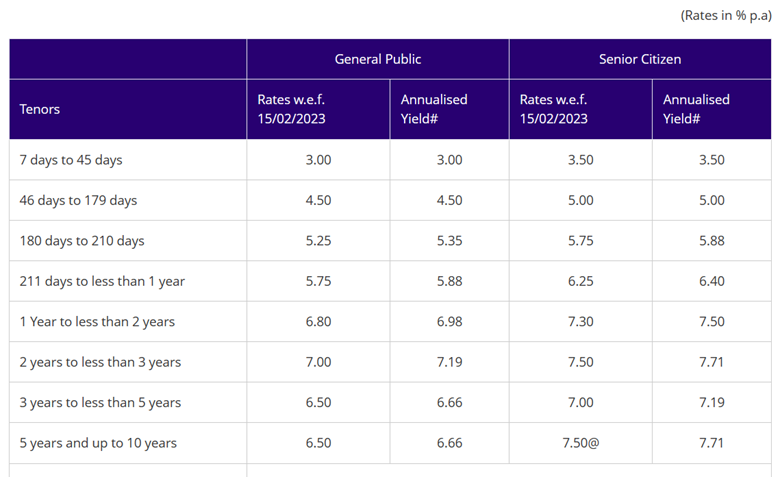

The rate of interest offered by banks keeps changing with changes in market conditions and their own liquidity needs. That being said, rates offered by most banks are generally aligned at most times.

FD rates offered by State Bank of India in May 2023 are presented below as a sample:

Risk

Deposits in all commercial banks (including foreign bank branches in India) and cooperative banks are insured up to Rs. 5 lacs per depositor per bank by the Depositor Insurance and Credit Guarantee Corporation (DICGC).

While there have been failures of private banks and cooperative banks, no scheduled commercial bank has failed in India in the last 50 years.

Liquidity

Fixed Deposits are considered liquid, as they are permitted to be withdrawn prematurely. The general rule followed by most banks is that of a 1% penalty. In other words, the interest paid on premature withdrawal will be 1% lower than the rate applicable for the period for which the FD has run, as offered on the date of placement.

Taxability

Income earned is taxable, within the overall income taxability of the depositor.

Competition

A bank FD is considered to be a baseline investment in India. Hence, all other investment options can be considered as competition. In any case, a Bank FD competes with the Bank FDs offered by all other banks.

Pros and Cons

+ Easy to deposit and withdraw

+ Rate is slightly lower than government schemes, but competitive

+ No amount limitation; any amount can be deposited

~ Income is fully taxable

~ Commercial organization risk with insurance up to 5 lacs

Offered by

All commercial banks in India

Website

Website of respective banks

Recommendation

Limit investment to insured limit and check for insurance coverage on: https://www.dicgc.org.in/FD_A-GuideToDepositInsurance.html#q1

Bank with established banking organizations or with government owned banks.