Investment

Philosophy

Underpinning any investment recommendations is an underlying investment philosophy. Here we articulate our investment philosophy so that you can see explicitly the important assumptions that underlie the suggestions we are making. If you agree with our investment philosophy, our approach is likely to be a good fit for you. If your view of the investment world is different, you should look at alternative solutions.

Resources

The core elements of the investment philosophy

01

Everything has risk.

02

Compounded returns result in exponential growth and over long periods small returns result in large amounts of accumulated value. In other words, small differences in rates of return over long periods will result in large differences in accumulated value.

03

Inflation reduces the value of money. Over long periods, the loss is significant.

04

Diversification reduces risk.

04

Markets are very competitive, and this makes it difficult to outperform the average market outcomes.

04

Asset Allocation is the most important investment decision.

04

Historically, equities have outperformed fixed income investments by a lot. – Equity returns going forward are likely to be lower than the past.

04

Historically, equities have outperformed fixed income investments by a lot. – Equity returns going forward are likely to be higher than fixed income returns.

04

There is the risk of large losses in equities.

04

Taxes have a significant impact on after tax investment returns. Managing taxes can add a lot of value in the investment process.

04

Defining and understanding your investment horizon can lead to better planning.

04

Keep the cost of investing low.

04

Buy the index.

04

Individuals and institutions – Who you are changes investment choices.

Use Cases

Platforms tailored to your needs

Start-ups

Agencies

Marketplace

Insurance

Investing

Corporate

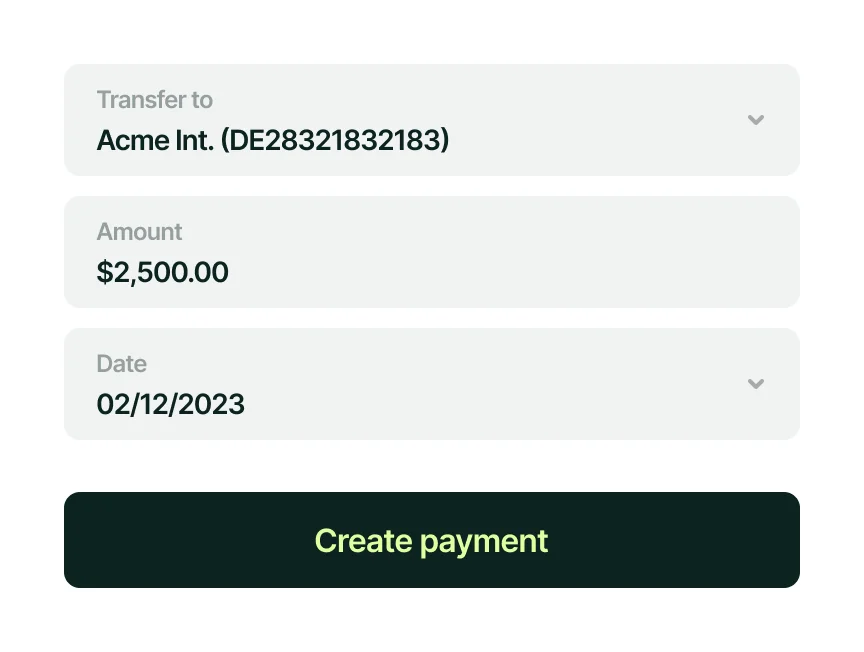

Initiate and track status of payments

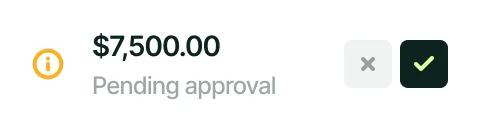

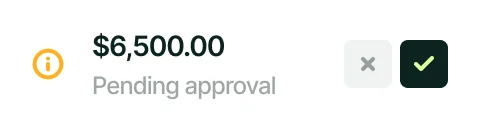

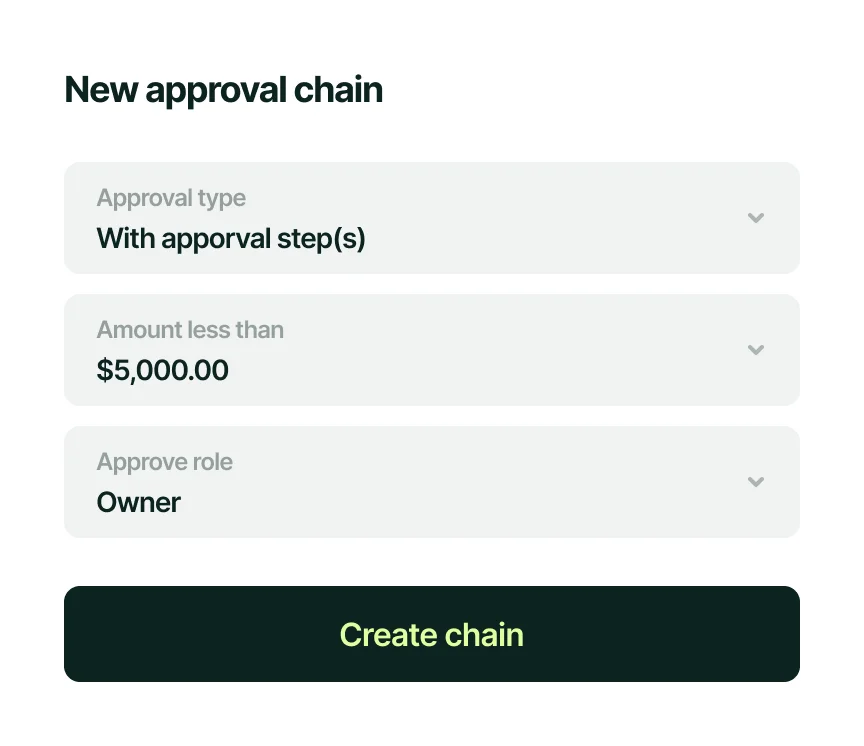

Auto approve payments with custom approval chains

Get started today

Wallet Integrations

Apple Pay

Paypal

Stripe